How Much Is The Homestead Exemption In Brazoria County . Here's how they work and how much you save by having. general residence homestead exemption (tax code section 11.13(a) and (b)): Current year (2021) approved tax exemptions. the tax rate (below) is per $100 of home value, as determined by the respective county appraisal district. how much does a homestead exemption save you on taxes in texas? homestead exemptions allow texas homeowners to save money on property tax bills. application for residence homestead exemption this application includes the following exemptions: the exemptions outlined in this section are collectively considered “residence homestead” exemptions. A general homestead exemption in texas can save you. in order to qualify for this option, the property (1) must be your residence homestead, and must have (2) an over 65 exemption; You may qualify for this exemption if:.

from dxonhgnar.blob.core.windows.net

application for residence homestead exemption this application includes the following exemptions: in order to qualify for this option, the property (1) must be your residence homestead, and must have (2) an over 65 exemption; Current year (2021) approved tax exemptions. general residence homestead exemption (tax code section 11.13(a) and (b)): homestead exemptions allow texas homeowners to save money on property tax bills. how much does a homestead exemption save you on taxes in texas? A general homestead exemption in texas can save you. the tax rate (below) is per $100 of home value, as determined by the respective county appraisal district. You may qualify for this exemption if:. Here's how they work and how much you save by having.

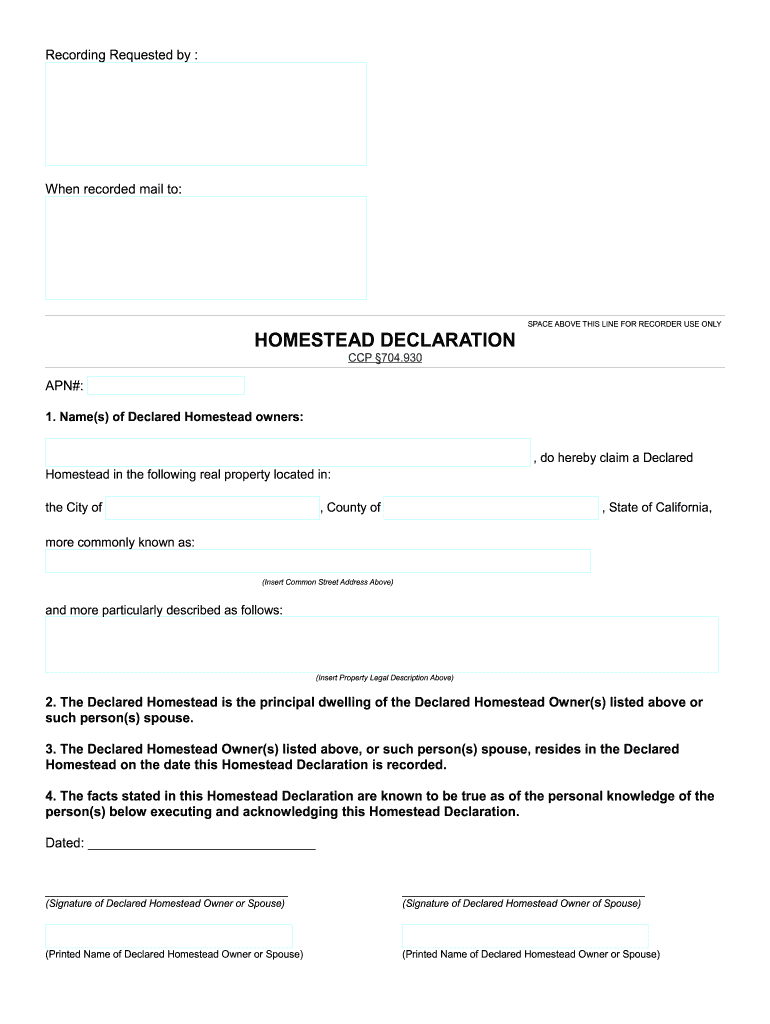

Property Tax Relief In California at Joy Eisenhower blog

How Much Is The Homestead Exemption In Brazoria County in order to qualify for this option, the property (1) must be your residence homestead, and must have (2) an over 65 exemption; application for residence homestead exemption this application includes the following exemptions: homestead exemptions allow texas homeowners to save money on property tax bills. how much does a homestead exemption save you on taxes in texas? in order to qualify for this option, the property (1) must be your residence homestead, and must have (2) an over 65 exemption; You may qualify for this exemption if:. Here's how they work and how much you save by having. the exemptions outlined in this section are collectively considered “residence homestead” exemptions. A general homestead exemption in texas can save you. the tax rate (below) is per $100 of home value, as determined by the respective county appraisal district. Current year (2021) approved tax exemptions. general residence homestead exemption (tax code section 11.13(a) and (b)):

From www.exemptform.com

Fillable Form Dte 105i Homestead Exemption Application For Disabled How Much Is The Homestead Exemption In Brazoria County application for residence homestead exemption this application includes the following exemptions: general residence homestead exemption (tax code section 11.13(a) and (b)): You may qualify for this exemption if:. how much does a homestead exemption save you on taxes in texas? in order to qualify for this option, the property (1) must be your residence homestead, and. How Much Is The Homestead Exemption In Brazoria County.

From www.pdffiller.com

Fillable Online Brazoria County Homestead Exemption Form. Brazoria How Much Is The Homestead Exemption In Brazoria County Current year (2021) approved tax exemptions. You may qualify for this exemption if:. in order to qualify for this option, the property (1) must be your residence homestead, and must have (2) an over 65 exemption; homestead exemptions allow texas homeowners to save money on property tax bills. Here's how they work and how much you save by. How Much Is The Homestead Exemption In Brazoria County.

From www.texasrealestatesource.com

Texas Homestead Tax Exemption Guide [New for 2024] How Much Is The Homestead Exemption In Brazoria County Here's how they work and how much you save by having. the exemptions outlined in this section are collectively considered “residence homestead” exemptions. how much does a homestead exemption save you on taxes in texas? the tax rate (below) is per $100 of home value, as determined by the respective county appraisal district. general residence homestead. How Much Is The Homestead Exemption In Brazoria County.

From printableformsfree.com

Fillable Texas Homestead Exemption Form 11 13 Printable Forms Free Online How Much Is The Homestead Exemption In Brazoria County homestead exemptions allow texas homeowners to save money on property tax bills. how much does a homestead exemption save you on taxes in texas? A general homestead exemption in texas can save you. in order to qualify for this option, the property (1) must be your residence homestead, and must have (2) an over 65 exemption; Here's. How Much Is The Homestead Exemption In Brazoria County.

From www.exemptform.com

Fillable Affidavit For Homestead Exemption When A Motor Vehicle Is How Much Is The Homestead Exemption In Brazoria County the tax rate (below) is per $100 of home value, as determined by the respective county appraisal district. A general homestead exemption in texas can save you. You may qualify for this exemption if:. application for residence homestead exemption this application includes the following exemptions: how much does a homestead exemption save you on taxes in texas?. How Much Is The Homestead Exemption In Brazoria County.

From exortoiws.blob.core.windows.net

Homestead Exemption Metairie at John Lunn blog How Much Is The Homestead Exemption In Brazoria County how much does a homestead exemption save you on taxes in texas? the tax rate (below) is per $100 of home value, as determined by the respective county appraisal district. You may qualify for this exemption if:. the exemptions outlined in this section are collectively considered “residence homestead” exemptions. homestead exemptions allow texas homeowners to save. How Much Is The Homestead Exemption In Brazoria County.

From www.exemptform.com

Chatham County Ga Homestead Exemption Form How Much Is The Homestead Exemption In Brazoria County application for residence homestead exemption this application includes the following exemptions: general residence homestead exemption (tax code section 11.13(a) and (b)): the exemptions outlined in this section are collectively considered “residence homestead” exemptions. homestead exemptions allow texas homeowners to save money on property tax bills. Current year (2021) approved tax exemptions. how much does a. How Much Is The Homestead Exemption In Brazoria County.

From exowmcxbh.blob.core.windows.net

House Parent Exemption at Maria Dagostino blog How Much Is The Homestead Exemption In Brazoria County general residence homestead exemption (tax code section 11.13(a) and (b)): application for residence homestead exemption this application includes the following exemptions: homestead exemptions allow texas homeowners to save money on property tax bills. the exemptions outlined in this section are collectively considered “residence homestead” exemptions. You may qualify for this exemption if:. in order to. How Much Is The Homestead Exemption In Brazoria County.

From appraisaldistrictruiega.blogspot.com

Appraisal District Appraisal District Brazos County How Much Is The Homestead Exemption In Brazoria County You may qualify for this exemption if:. Current year (2021) approved tax exemptions. general residence homestead exemption (tax code section 11.13(a) and (b)): how much does a homestead exemption save you on taxes in texas? the exemptions outlined in this section are collectively considered “residence homestead” exemptions. the tax rate (below) is per $100 of home. How Much Is The Homestead Exemption In Brazoria County.

From www.dochub.com

Homestead exemption Fill out & sign online DocHub How Much Is The Homestead Exemption In Brazoria County application for residence homestead exemption this application includes the following exemptions: Here's how they work and how much you save by having. general residence homestead exemption (tax code section 11.13(a) and (b)): how much does a homestead exemption save you on taxes in texas? A general homestead exemption in texas can save you. Current year (2021) approved. How Much Is The Homestead Exemption In Brazoria County.

From www.lendingtree.com

What Is a Homestead Exemption and How Does It Work? LendingTree How Much Is The Homestead Exemption In Brazoria County the exemptions outlined in this section are collectively considered “residence homestead” exemptions. You may qualify for this exemption if:. Current year (2021) approved tax exemptions. the tax rate (below) is per $100 of home value, as determined by the respective county appraisal district. application for residence homestead exemption this application includes the following exemptions: A general homestead. How Much Is The Homestead Exemption In Brazoria County.

From www.exemptform.com

Florida Homestead Exemption Form Broward County How Much Is The Homestead Exemption In Brazoria County how much does a homestead exemption save you on taxes in texas? the exemptions outlined in this section are collectively considered “residence homestead” exemptions. Here's how they work and how much you save by having. general residence homestead exemption (tax code section 11.13(a) and (b)): A general homestead exemption in texas can save you. application for. How Much Is The Homestead Exemption In Brazoria County.

From www.vrogue.co

Homestead Exemption Form Fill Out And Sign Printable Pdf Template Vrogue How Much Is The Homestead Exemption In Brazoria County in order to qualify for this option, the property (1) must be your residence homestead, and must have (2) an over 65 exemption; Here's how they work and how much you save by having. A general homestead exemption in texas can save you. You may qualify for this exemption if:. the exemptions outlined in this section are collectively. How Much Is The Homestead Exemption In Brazoria County.

From blog.squaredeal.tax

How much does Homestead Exemption save in Texas? Square Deal Blog How Much Is The Homestead Exemption In Brazoria County A general homestead exemption in texas can save you. homestead exemptions allow texas homeowners to save money on property tax bills. You may qualify for this exemption if:. in order to qualify for this option, the property (1) must be your residence homestead, and must have (2) an over 65 exemption; how much does a homestead exemption. How Much Is The Homestead Exemption In Brazoria County.

From www.exemptform.com

Harris County Homestead Exemption Form How Much Is The Homestead Exemption In Brazoria County homestead exemptions allow texas homeowners to save money on property tax bills. application for residence homestead exemption this application includes the following exemptions: in order to qualify for this option, the property (1) must be your residence homestead, and must have (2) an over 65 exemption; the tax rate (below) is per $100 of home value,. How Much Is The Homestead Exemption In Brazoria County.

From www.exemptform.com

Bartow County Ga Homestead Exemption Form How Much Is The Homestead Exemption In Brazoria County in order to qualify for this option, the property (1) must be your residence homestead, and must have (2) an over 65 exemption; the exemptions outlined in this section are collectively considered “residence homestead” exemptions. You may qualify for this exemption if:. how much does a homestead exemption save you on taxes in texas? homestead exemptions. How Much Is The Homestead Exemption In Brazoria County.

From www.firsthomehouston.com

How to Apply for Your Homestead Exemption Plus Q and A — First Home How Much Is The Homestead Exemption In Brazoria County general residence homestead exemption (tax code section 11.13(a) and (b)): A general homestead exemption in texas can save you. how much does a homestead exemption save you on taxes in texas? the exemptions outlined in this section are collectively considered “residence homestead” exemptions. the tax rate (below) is per $100 of home value, as determined by. How Much Is The Homestead Exemption In Brazoria County.

From cedarparktxliving.com

Texas Homestead Tax Exemption Cedar Park Texas Living How Much Is The Homestead Exemption In Brazoria County A general homestead exemption in texas can save you. the tax rate (below) is per $100 of home value, as determined by the respective county appraisal district. the exemptions outlined in this section are collectively considered “residence homestead” exemptions. in order to qualify for this option, the property (1) must be your residence homestead, and must have. How Much Is The Homestead Exemption In Brazoria County.